wake county nc sales tax rate 2019

3 rows Sales Tax Breakdown. This table shows the total sales tax rates for all cities and towns in Wake.

Taxes Cary Economic Development

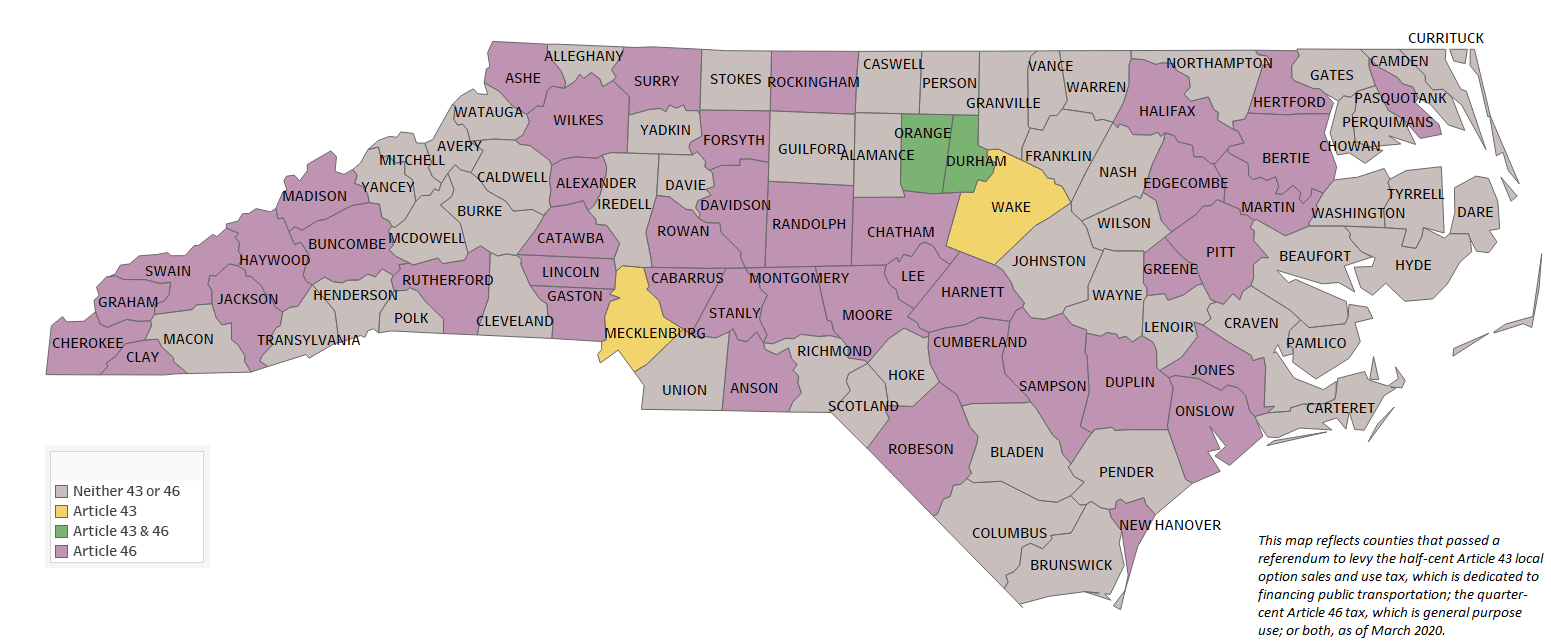

Historical Total General State Local and Transit Sales and Use Tax Rates.

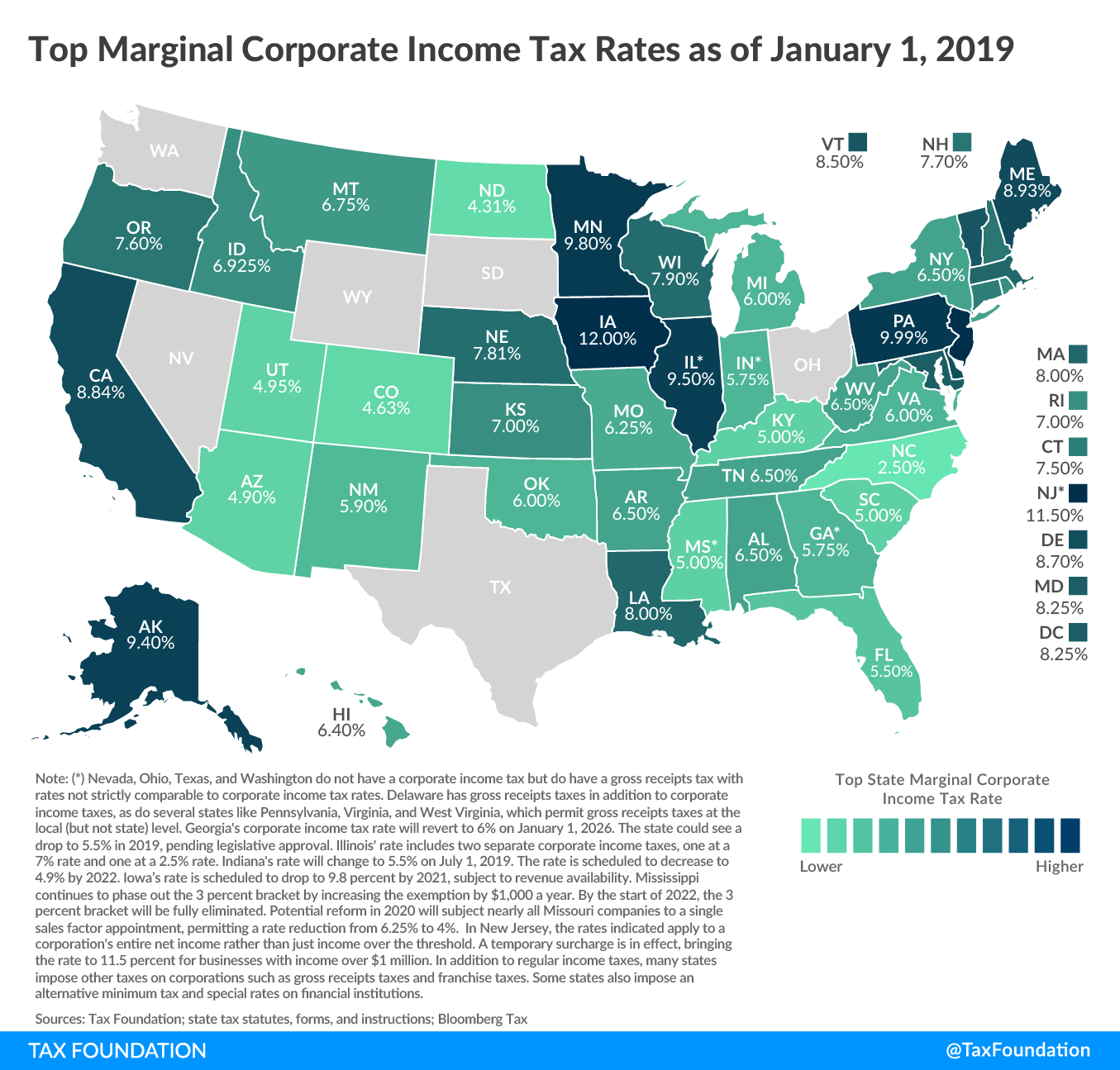

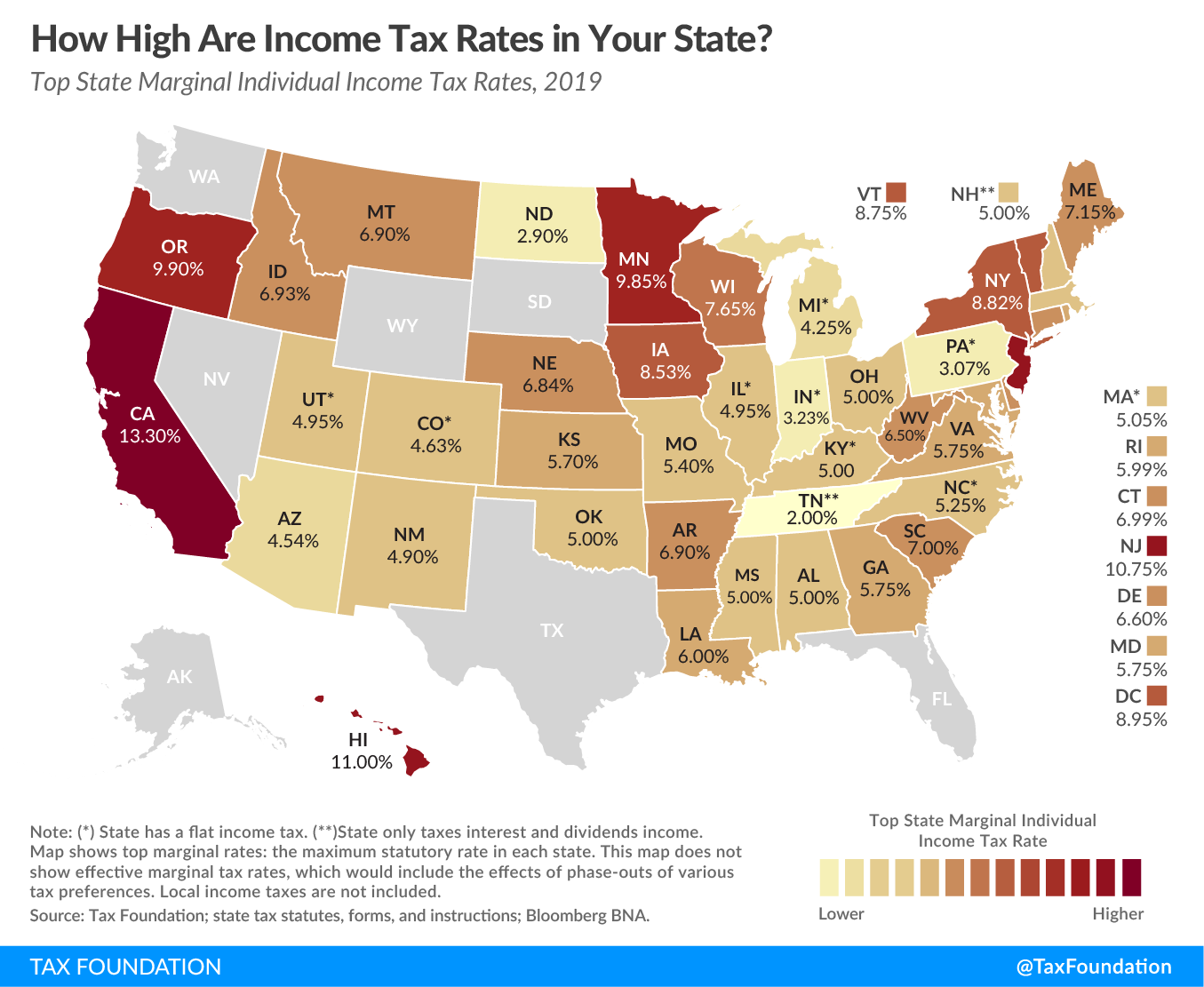

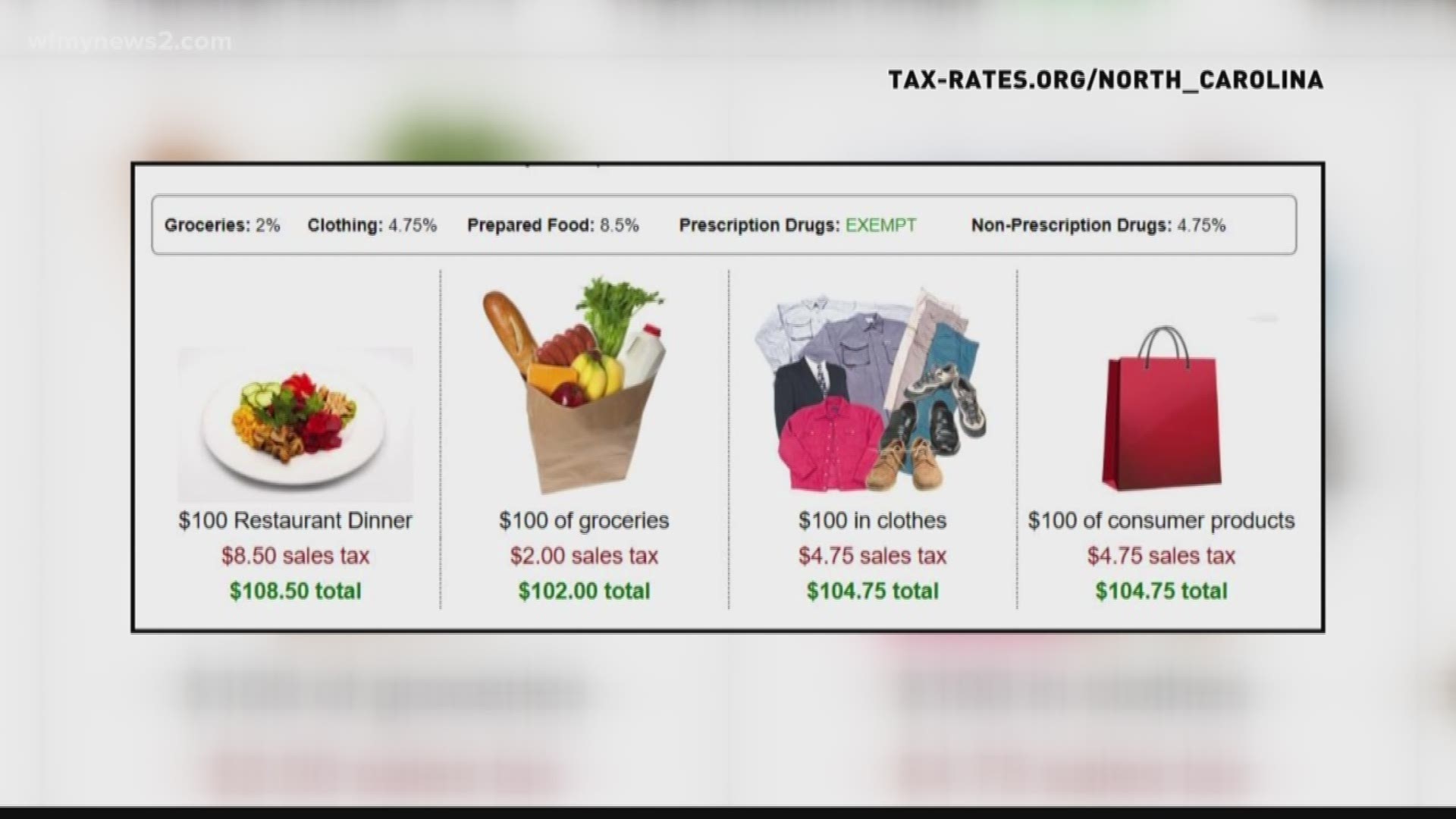

. The corporate income tax rate for North Carolina will drop to 30 starting January 2017. Sales and Use Tax Forms and Certificates. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Sales and Use Tax Rates Effective April 1 2019 NCDOR. 85 x 7027 5973 estimated annual tax.

Download tax rate tables by state or find rates for individual addresses. The North Carolina state sales tax rate is currently. PO Box 25000 Raleigh NC 27640-0640.

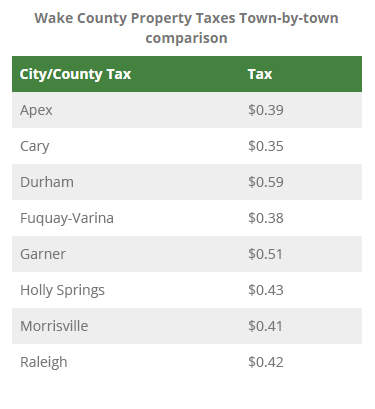

Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143 counties in. The state will phase-in a single sales factor in the 2016 and 2017 tax years with a 100 sales factor imposed in the 2018 tax year. The current total local sales tax rate in Vance County NC is 6750.

Walk-ins and appointment information. County rate 60 Fire District rate 1027 Combined Rate 7027 No vehicle fee is charged if the property is not in a municipality Property value divided by 100. Average Sales Tax With Local.

Wake County sales tax. Sales and Use Tax Rates Effective October 1 2020. With local taxes the total sales tax rate is between 6750 and 7500.

Historical Total General State Local and Transit Sales and Use Tax Rates. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

For tax rates in other cities see North Carolina sales taxes by city and county. The December 2020 total local sales tax rate was also 6750. North Carolina state sales tax.

Wake County collects on average 081 of a propertys assessed fair market value as property tax. North Carolina has recent rate changes Fri Jan 01 2021. Free Unlimited Searches Try Now.

North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes. 05 lower than the maximum sales tax in NC. You can print a 7 sales tax table here.

The 7 sales tax rate in Warsaw consists of 475 North Carolina state sales tax and 225 Duplin County sales tax. Listed below by county are the total. 35 rows 700.

And local sales tax rates over the past two years including 10 with increases in the first half of 2019. The Wake County sales tax rate is. There is no applicable city tax or special tax.

North Carolina Sales Tax. The state sales tax rate in North Carolina is 4750. A Transit Improvement Area sales tax increase affected rates in.

This is the total of state and county sales tax rates. North Carolina Department of Revenue. The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales.

Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh. Ad Lookup State Sales Tax Rates By Zip. The 2018 United States Supreme Court decision in South Dakota v.

Sales and Use Tax Rates Other Information. The minimum combined 2022 sales tax rate for Wake County North Carolina is. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates.

Select the North Carolina city from the list of popular cities below to. Appointments are recommended and walk-ins are first come first serve. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates.

Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh is the county seat authorized a rate increase in 2017 as did officials in Albuquerque New Mexico and the District of Columbia in 2018. January 2022s Median Sales Price for Wake County Real Estate came in at 410000 down only 1k from December 2021. What is the sales tax rate in Wake County.

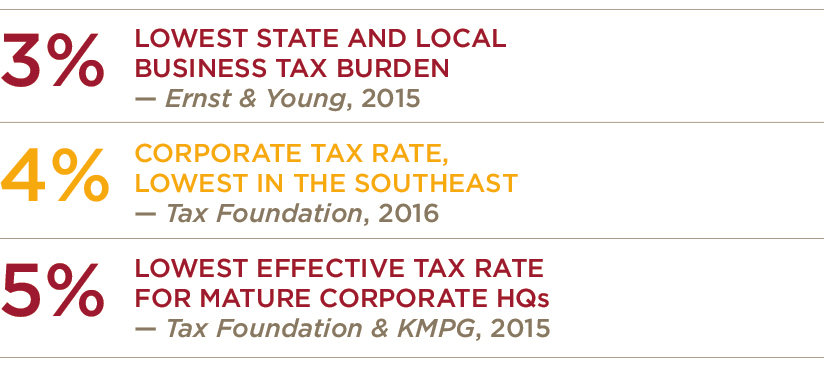

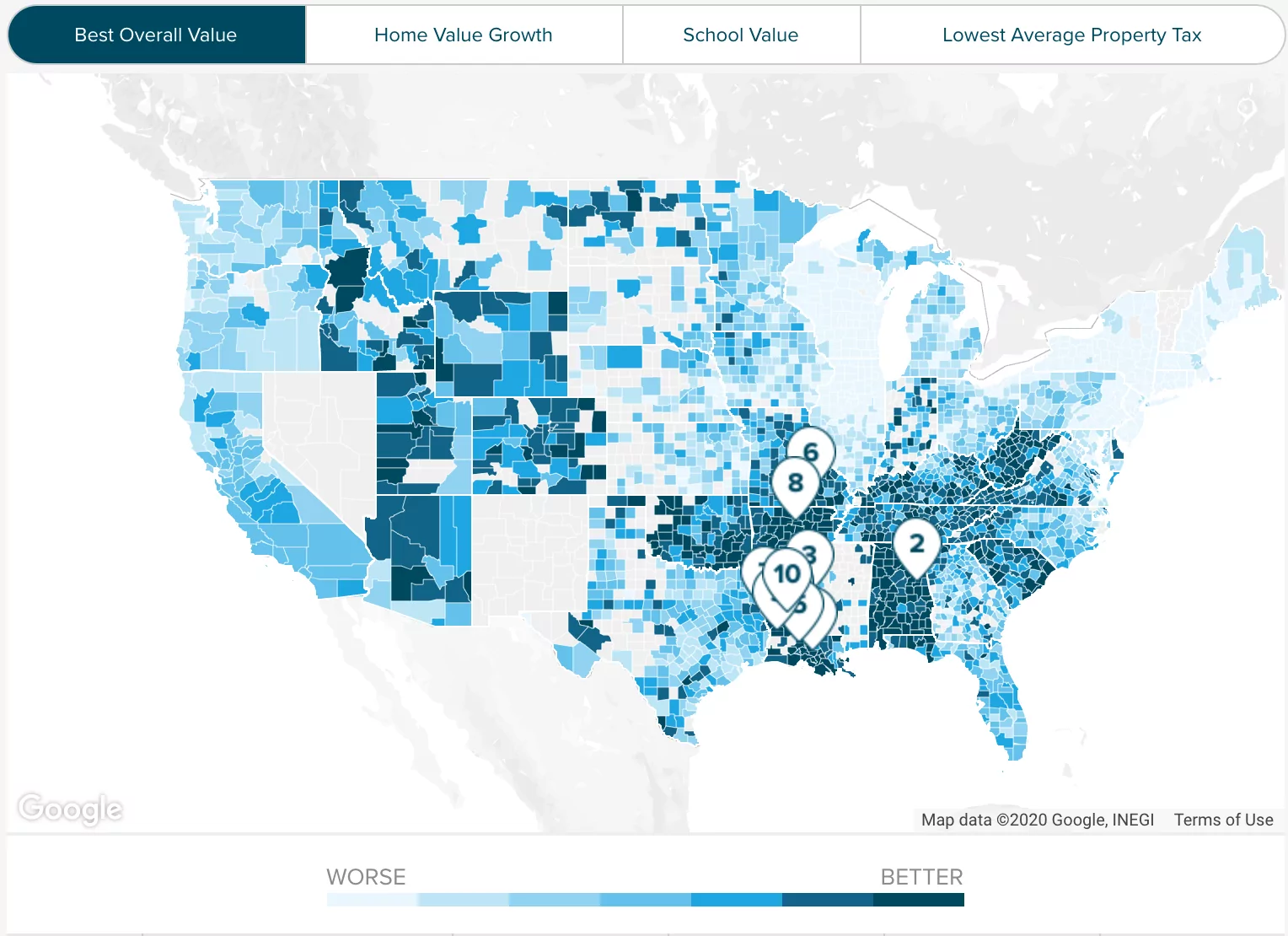

Wake County enjoys a competitive tax environment which helps to create one of the most pro-business cities in America.

Taxes Wake County Economic Development

Wake County North Carolina Property Tax Rates 2020 Tax Year

Taxes Cary Economic Development

Wake County Nc Property Tax Calculator Smartasset

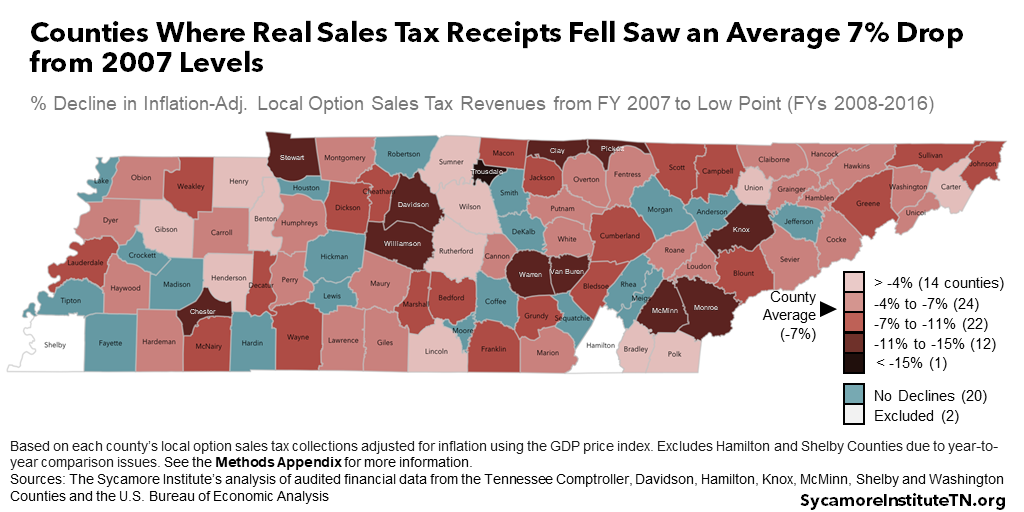

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Taxes In The United States Wikiwand

Taxes Cary Economic Development

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Tax On Grocery Items Taxjar

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

County Elections North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Sales Taxes In The United States Wikiwand

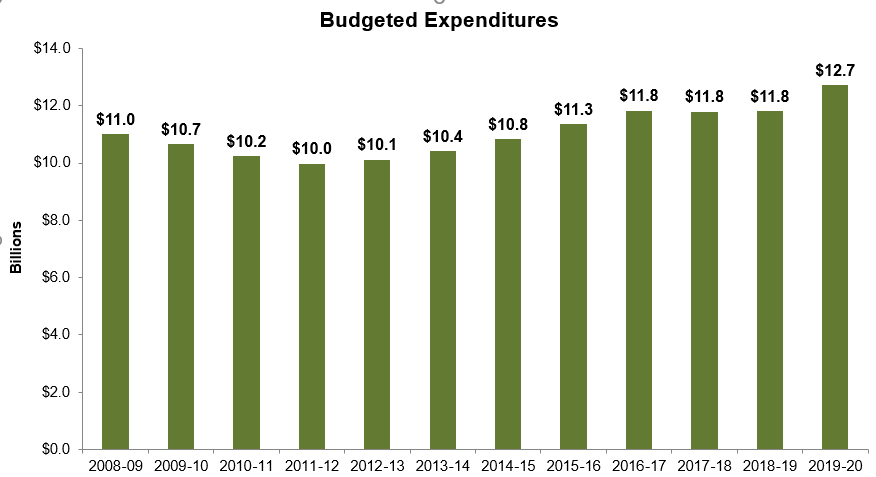

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Fact Check How Does Biden S Corporate Tax Rate Compare To Other Countries Wral Com

Property Taxes By State Embrace Higher Property Taxes